td ameritrade tax lot method

Access Powerful Trading Tools Education and More. The data will be in a summary table format by tax year with the ability to get a detailed report by tax lot Tax Reports-This section is a report-filtering page that generates custom reports to.

Income tax situation and liquidity needs.

. Get Your Max Refund Today. Access Powerful Trading Tools Education and More. Where Smart Investors Get Smarter.

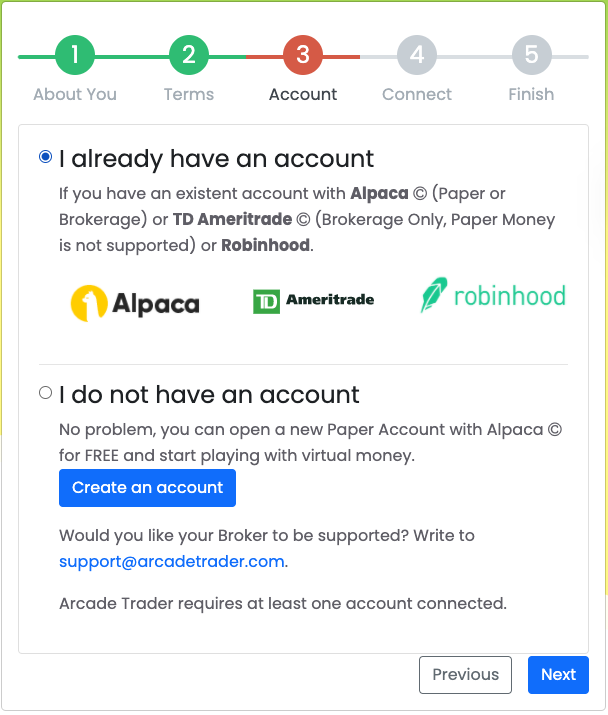

Club_cafe Synching Tax Lots from TDAmeritrads Dear fellow investors We are new to Bivio. Current law only permits this method for mutual fund shares. The shares purchased at 5001 on January 1.

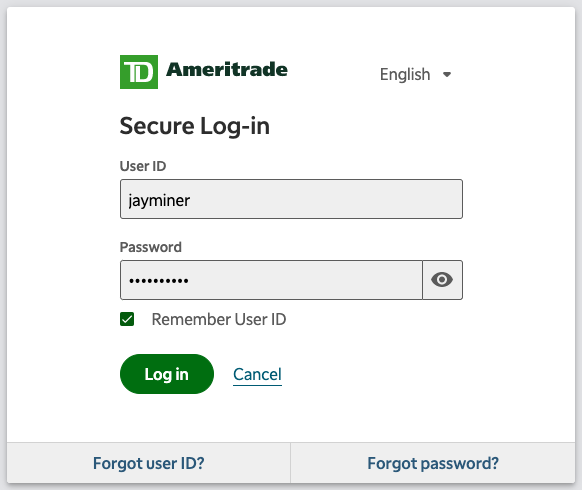

Ad Access a Depth of Elite Tools Available in our thinkorswim trading Platforms. TD Ameritrades algorithm will see that these are all short-term gains and so it will sell the lot with the highest purchase price. The specific lot method offers the best financial outcome since it forces you to be actively aware of your investments and tax liability.

Ad Access a Depth of Elite Tools Available in our thinkorswim trading Platforms. Lot-specific trade assignments will need to be made by 1159 pm. AMTD today announced a new tax-loss harvesting.

Where Smart Investors Get Smarter. Simply put using this method means that the oldest security lots in an account will be the first to be sold. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

You must want to hold the stock long. Methods of Analysis Investment Strategies and Risk of Loss 10 9. You can only set the default tax lot method by security type equitiesoptionsfunds not by security.

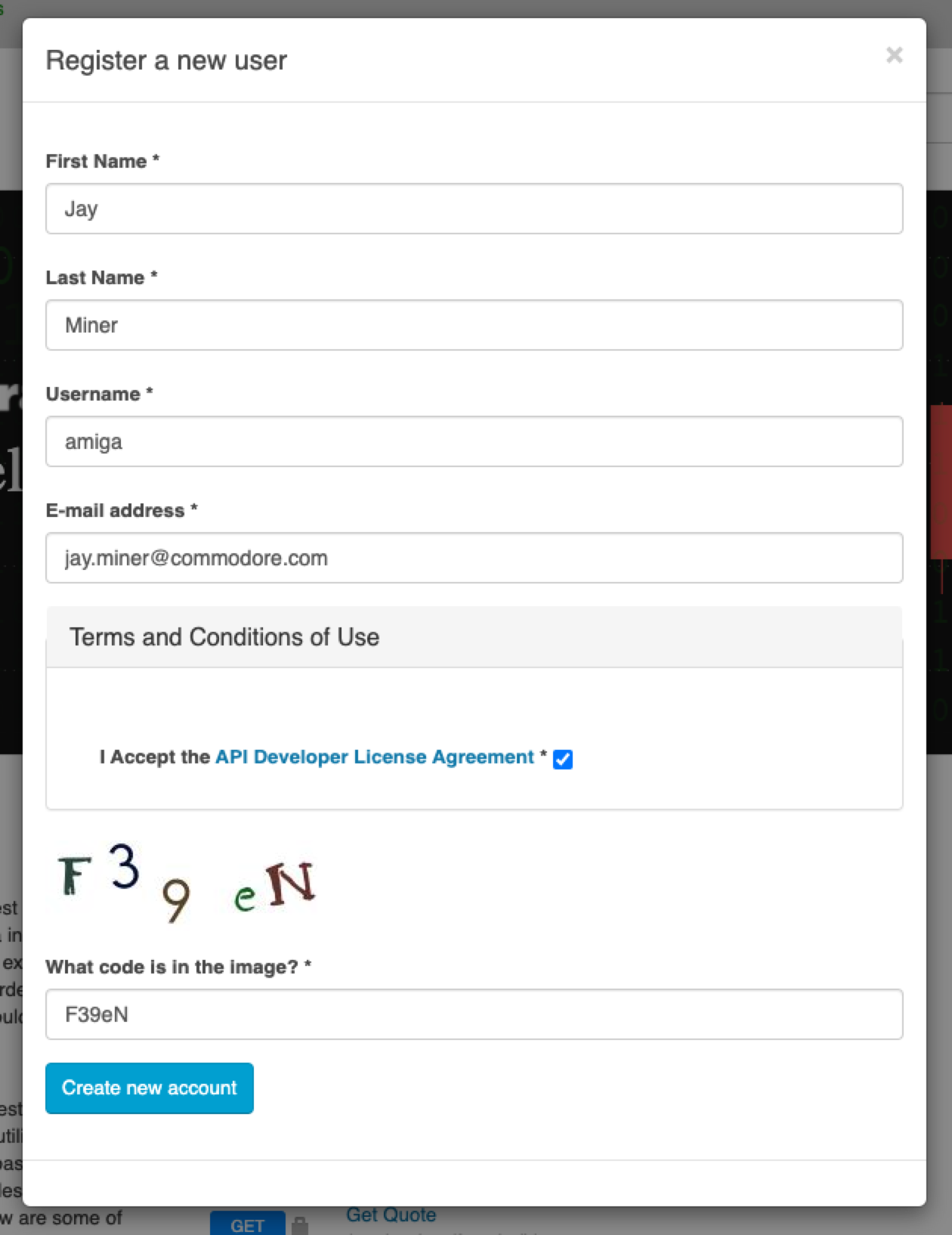

TD Ameritrade Investment Management LLC a registered investment advisor subsidiary of TD Ameritrade Holding Corporation Nasdaq. Tax lot ID methods we support. The ability to assign a specific lot for your trade is located on the GainLoss.

What is TD Ameritrade default tax lot. This is the quickest and most efficient method to create the order. The Emergency Economic Stabilization Act of 2008 requires that brokerage firms and mutual fund companies report their customers cost basis and holding period on covered.

FIFO first-in first-out LIFO last-in first-out Highest cost Lowest cost Specific lot Tax efficient loss harvester Average cost First-in first-out FIFO selects the. One disadvantage of the LIFO method is that the lot you are selling is the most recently bought and may be held for less than one year and the capital gains are short-term. Disciplinary Information 11.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Every custodian and broker is required to maintain a default method for lot relief and alert their customers to which method. We may also review and discuss a clients prior.

Share your videos with friends family and the world. After adjusting the order to your specifications click Confirm and Send and review the Order Confirmation Dialog prior to. Make The Change Its easy to change the.

Using FIFO the default your. ET on the settlement date. Should the market price of the security rise over time holding the long-term tax lot will mean you will be taxed at long-term capital gains rates should you sell those securities for a profit.

How do we set Bivio to synch up with the Tax Lot selection made from. But when you place a sell order you can specify LIFO FIFO low cost high cost or tax. Of course averaging down or covered calls and cash secured puts all have the same fundamental thing that much remain true to be profitable long term.

Tax Filing Myth Buster 1099 Deadlines For Brokerage Ticker Tape

The Most Important Guide Thinkorswim Tutorial 2022

Deposit Withdrawal For International Investors R Tdameritrade

Tax Filing Myth Buster 1099 Deadlines For Brokerage Ticker Tape

Tax Filing Myth Buster 1099 Deadlines For Brokerage Ticker Tape

The Most Important Guide Thinkorswim Tutorial 2022

Etrade Switch Fifo Or Lifo Zero Brokerage Trading Company Global Village Network